Scaling a finance team in 2026 requires more than just hiring new headcount; it requires a fundamental shift in how your organization manages its operational pulse. As transaction volumes surge and remote teams become the norm, the manual processes that worked at $5M ARR become the very chains that hold you back at $20M ARR.

For modern finance leaders, the goal is no longer just “keeping the books.” It is about mastering operational complexity to drive strategic growth. This guide explores why the “Scaling Trap” exists and identifies the best procurement software features you need to navigate the fiscal landscape of 2026.

Table of Contents

Why Scaling Finance Teams Are Falling into the Scaling Trap

What is the Scaling Trap in finance? The “Scaling Trap” occurs when a company’s revenue growth outpaces its back-office operational capacity. It is characterized by finance teams spending increasing amounts of time on low-value manual tasks—like data entry and chasing approvals—instead of strategic analysis, leading to operational bottlenecks that stall company-wide growth.

The Hidden Dangers of Relying on Manual Spreadsheets

Spreadsheets are the comfortable default for early-stage startups, but they are dangerous for scaling businesses. In 2026, relying on Excel to track accruals or manage approvals invites disaster.

- Data Fragility: Broken formulas and version control issues can lead to significant financial restatements.

- Latency: Spreadsheets only tell you what happened last month, not what is being spent right now.

- Security Risks: Emailing sensitive financial data back and forth creates vulnerabilities.

Eliminating these manual inefficiencies is the first step to drive real procurement cost savings.

How Operational Debt Slows Down Company Growth

Just as engineering teams accumulate “technical debt,” finance teams accumulate “operational debt.” This is the invisible cost of inefficient processes. When your highly paid finance talent spends 15 hours a week copying data from invoices into your ERP, you are paying high interest on that debt. This friction forces leadership to focus on administrative cleanup rather than strategic initiatives.

Why Legacy ERP Systems Fail to Stop Shadow IT

Many organizations assume their ERP (Enterprise Resource Planning) system is sufficient. However, legacy ERPs are often designed for accountants, not for the end-users making purchases. When the “official” system is clunky, employees resort to “Shadow IT”—buying software on corporate cards without approval. This leaves Finance completely in the dark until the credit card bill arrives.

Action Steps: Audit Your Debt

- Audit your current process: Identify exactly how many hours per week are spent on manual data entry versus strategic work.

- List subscriptions: Catalog every software subscription currently being paid for on employee credit cards to gauge the extent of Shadow IT.

- Identify bottlenecks: Pinpoint the top three bottlenecks in your approval workflow that cause payment delays.

What Is Cloud Procurement Software?

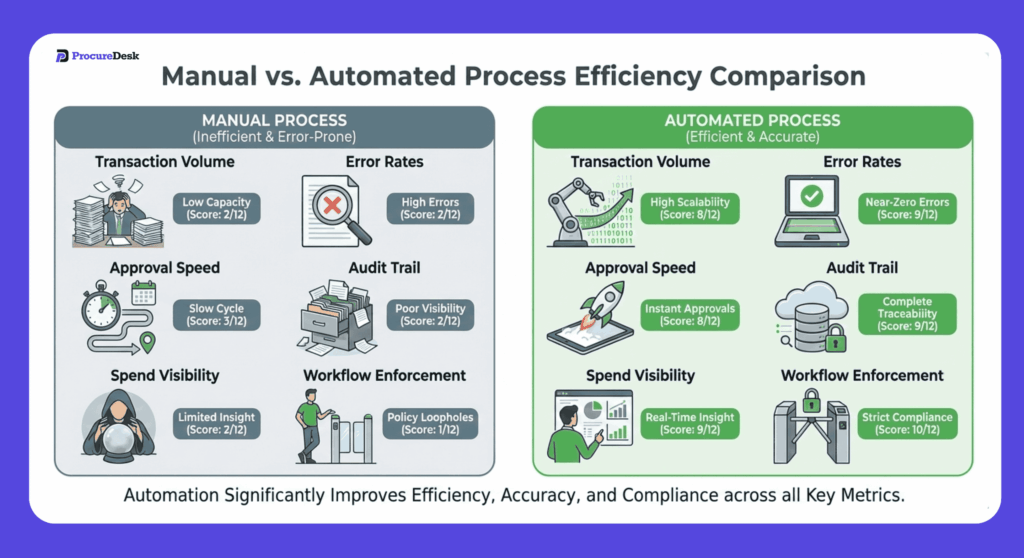

Cloud procurement software is a web-based platform that automates the entire procure-to-pay system for organizations. Unlike legacy on-premise tools, these platforms are cloud-native, offering real-time visibility into spending, automated approval workflows, and seamless integration with accounting systems. They empower finance teams to move from reactive data entry to proactive spend management.

The Financial Risks of Delaying Finance Automation Tools

The cost of inaction is quantifiable and severe. Delaying the transition to a dedicated procurement platform results in:

- Duplicate Payments: Often ranging from 0.5% to 1% of total disbursements due to lack of visibility.

- Missed Savings: Inability to capture early-payment discounts or negotiate volume pricing.

- Audit Failures: The lack of a digital audit trail makes the company vulnerable to internal fraud and regulatory penalties.

7 Essential Features the Best Procurement Software Must Have in 2026

To avoid the scaling trap, your finance stack needs more than just a repository for data; it needs active intelligence. When evaluating software, ensure it includes these seven mission-critical features.

1. Seamless ERP Integration for Accurate Reporting

Why it matters: In 2026, data silos are an operational failure. The best procurement software acts as a direct feeder to your accounting system. Look for native, API-driven syncs with major ERPs like NetSuite, QuickBooks, or Xero. This ensures that every Purchase Order (PO) and approved invoice is instantly pushed to your general ledger without a single keystroke.

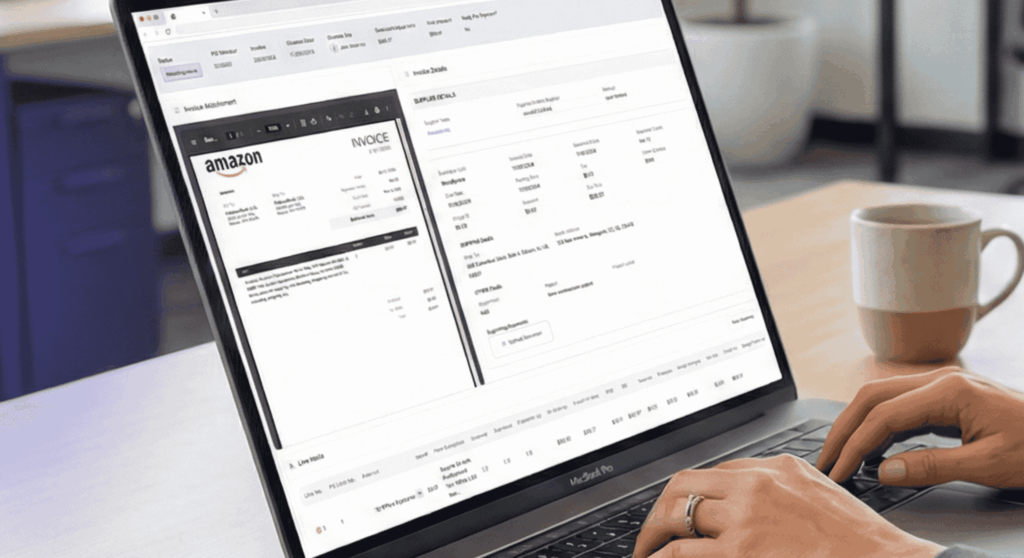

2. Automating Data Entry Using Optical Character Recognition (OCR)

Why it matters: Manual typing is the primary source of accounting errors. Modern platforms utilize AI-driven Optical Character Recognition (OCR) to automatically scan invoices and receipts. The system extracts key data—vendor name, invoice date, line items, and amounts—and maps them to your GL codes automatically.

3. Creating Automated Purchase Orders to Standardize Buying

Why it matters: You cannot control spend that has already happened. Standardization is the enemy of chaos. Implementing robust purchase order software ensures that every request generates a formal document with a distinct paper trail. This guarantees that funds are committed before the order is placed with the vendor.

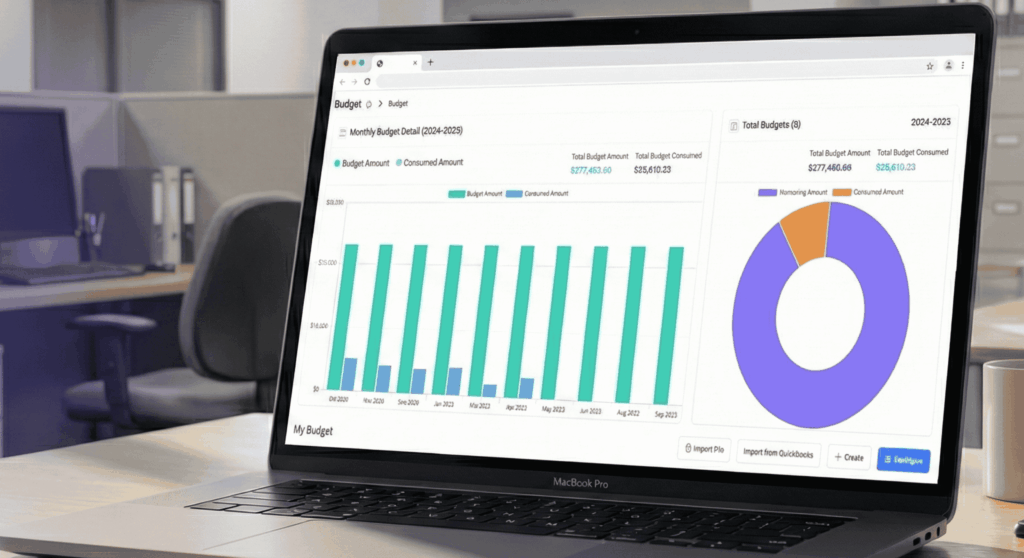

4. Implementing Real-Time Budget Checks Before Spending Happens

Why it matters: Policy documents in a drawer don’t stop overspending; active systems do. Advanced platforms check purchase requests against available budgets in real-time. If a marketing manager tries to open a PO that exceeds their Q1 budget, the system can flag it or block it immediately. This stops overspending at the point of requisition.

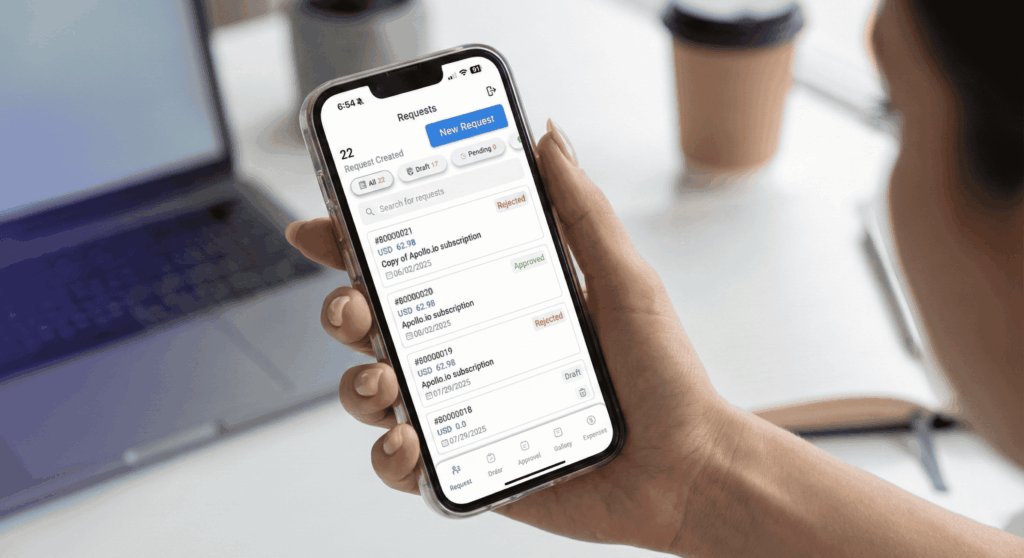

5. Streamlining Approval Workflows for Faster Decision Making

Why it matters: Speed is a competitive advantage. Bottlenecks kill operational momentum. Dynamic workflows automatically route requests based on variables like department or dollar amount. This logic significantly speeds up the purchase order approval process, reducing the cycle time from “I need this” to “Order Placed.”

6. Ensuring 3-Way Matching to Eliminate Payment Errors

Why it matters: Scaling volume increases the risk of overpayment. 3-way matching is the gold standard of accounts payable. It automatically verifies that three documents match perfectly before payment is authorized:

- The Purchase Order (What you ordered)

- The Receiving Document (What was delivered)

- The Vendor Invoice (What you are being billed for)

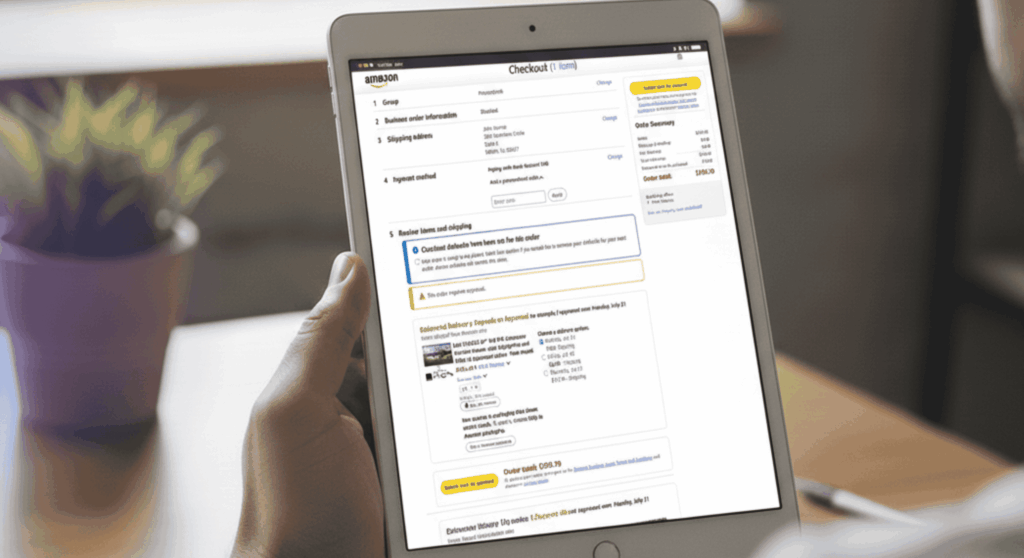

7. Catalog Management to Centralize Purchasing

Why it matters: Convenience drives compliance. “Maverick spend” often happens simply because it is easier to buy on Amazon than through company channels. Catalog management with “Punch-out” capabilities solves this by integrating vendors like Amazon Business directly into your procurement platform.

Action Steps: Audit Your Features

- Audit your current stack: Specifically list which of these seven features your current system lacks.

- Map your workflows: Define the approval limits and routing rules you would implement if your software supported automation.

- Calculate the gap: Estimate how many hours per week your team currently spends on manual data entry and 3-way matching.

How ProcureDesk Delivers Real-Time Control Over Spend

Knowing the features is one thing; seeing them in action is another. Here is how ProcureDesk brings these elements together to solve the mid-market scaling problem.

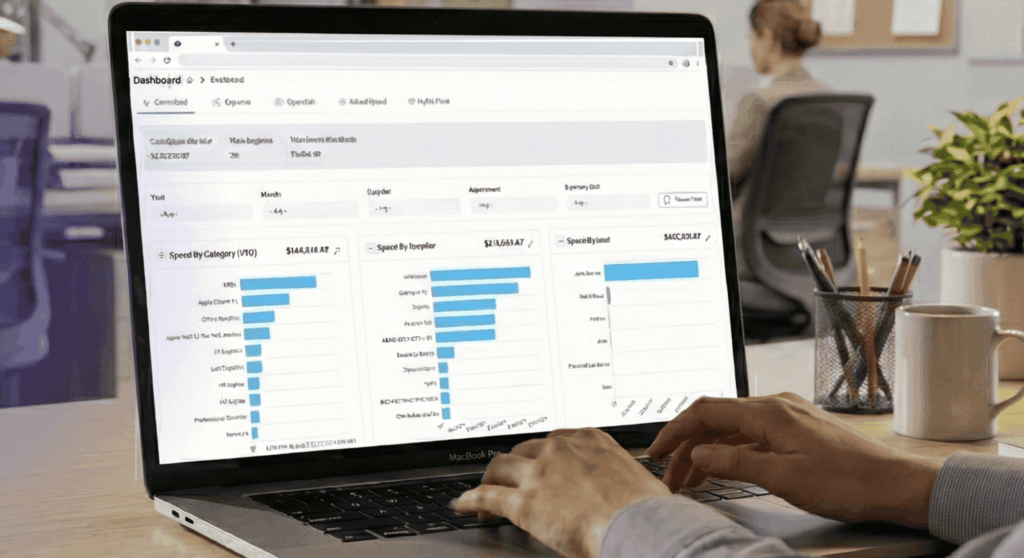

Moving From Reactive Reporting to Proactive Spend Management

Most finance teams are stuck acting as scorekeepers, recording what has already been spent. ProcureDesk shifts your role to gatekeeper. By utilizing specialized spend management software, you capture spend data at the request stage. This allows you to influence spending behavior before cash leaves the building.

Centralizing All Requests and Approvals in One Platform

ProcureDesk creates a single source of truth. It consolidates scattered emails, Slack messages, and paper forms into one unified dashboard.

- The Result: Every stakeholder—from the requester to the approver to the accountant—looks at the same data. This clarity eliminates “he said, she said” disputes and ensures accountability.

Preventing Fraud and Unauthorized Purchases with Digital Audit Trails

Security is built-in, not bolted on. Every action in ProcureDesk is logged in an immutable digital audit trail. You can see exactly who requested an item, who approved it, and when. This transparency is your best defense against internal fraud and ensures you sail through external audits with zero stress.

Scaling Operations Without Hiring More Staff for Data Entry

Efficiency is the ultimate ROI. ProcureDesk automates the heavy lifting of data entry, routing, and reconciliation.

- The Metric: This automation allows your existing finance team to handle 2x or 3x the transaction volume without needing to add headcount. You scale your operations, not your payroll.

How ProcureDesk Integrates with Your Existing Finance Stack

You don’t need to replace your current systems; you need to enhance them. ProcureDesk connects seamlessly with your existing finance ecosystem, pushing clean, approved data directly into your general ledger.

Action Steps: Audit Your Workflow

- Audit your current approval channels: List every way an employee currently asks for money (Email, Slack, text, paper forms).

- Identify the bottlenecks: Determine where your finance team spends the most time chasing information.

- Check compatibility: Ensure any software you evaluate has a native integration with your current accounting software (QuickBooks, Xero, etc.).

Comparing Modern Spend Management Solutions vs. Legacy ERPs

Is a dedicated tool really necessary? Here is how modern solutions stack up against traditional ERP modules.

| Feature | Legacy ERP Systems | Modern Spend Management (ProcureDesk) |

| Usability | Complex, requires training; high barrier to entry. | Intuitive, consumer-grade UI; minimal training needed. |

| Implementation | Months or Years; heavy IT involvement. | Weeks; rapid deployment with low-code setup. |

| Visibility | Historical / Post-Invoice; “Rear-view mirror” data. | Real-Time / Pre-Spend; “Headlights” visibility. |

| Cost | High implementation fees & maintenance costs. | Low monthly subscription; predictable OpEx. |

| Adoption | Low; users bypass it creating “Shadow IT.” | High; users prefer the ease of use. |

Why ERP Add-Ons Are Often Too Complex for Daily Users

ERP procurement modules are often designed by accountants, for accountants. They are powerful but notoriously difficult for the average employee to use. ProcureDesk is designed for the end-user first, ensuring that a marketing director or lead engineer can submit requests in seconds without needing a training manual.

The Speed of Implementation for Cloud-Based Tools

Time-to-value is critical in 2026. Legacy ERP implementations can drag on for 6-12 months. Modern cloud-based tools can be up and running in weeks. This agility allows you to solve your spending problems this quarter, not next year.

Action Steps: Audit Your UX

- Audit your current user interface: Ask a non-finance employee to attempt a purchase in your current system and watch where they get stuck.

- Request implementation timelines: When talking to vendors, ask for average deployment times for companies of your size.

- Check mobile capabilities: Ensure the software you choose has a mobile app or responsive design, as this heavily influences adoption.

Evaluating the Total Cost of Ownership for New Finance Tools

Investing in software is a business decision that requires a clear business case. Here is how to build yours.

Calculating the Hidden Costs of Manual Data Entry

Don’t fall for the trap that spreadsheets are “free.” Calculate the true cost:

- Formula: (Finance Staff Hourly Rate) x (Hours spent on manual entry/correction per week) x 52 weeks. You will likely find that your “free” process is costing you tens of thousands of dollars annually in lost productivity alone.

Estimating Savings from Fraud Prevention and Error Reduction

Factor in the “hard savings.” Eliminating duplicate payments and consolidating vendors are the fastest ways to reduce overhead.

- Duplicate Payments: Eliminating these can save 0.5% – 1% of total spend.

- Maverick Spend: Bringing spend under management typically reduces costs by 5-10% through vendor consolidation and contract enforcement.

Future-Proofing Your Finance Stack for 2026 and Beyond

Selecting the right software is about preparing for the future. By implementing a scalable, cloud-based foundation now, you ensure your finance stack can adapt to new technologies leading up to 2026. You are building a system that grows with you, not one you will outgrow in a year.

Action Steps: Build Your Case

- Audit your team’s time: Have your AP staff track how many hours they spend on manual data entry for one week.

- Calculate the labor cost: Multiply those hours by their hourly wage to find your current weekly “manual tax.”

- Request full quotes: Ask shortlisted vendors to break down their pricing into recurring license fees and one-time implementation costs.

Ready to eliminate manual data entry?

Stop letting spreadsheets dictate your growth. See how ProcureDesk helps scaling finance teams control spend in real-time. Request a Demo with ProcureDesk.