If you want to improve the profitability of your business and lower your operational costs, this blog is for you.

We’ve detailed the 15 top tips to help you strategically keep up with cost-reduction efforts for your business. By the end of this blog, you’ll understand saving opportunities that you might have often overlooked and even learn how to gain insights into your company’s day-to-day operation expenses.

What Are Operating Costs?

Operating costs, or OpEx, are expenses your business incurs through its normal business operations.

Think of it as money you spend to keep your business running.

Here are the most common operational costs:

- Cost of goods sold (COGS): This includes the direct costs of producing the goods or services that your business sells, such as raw materials, labor, and factory overhead.

- Selling, general, and administrative (SG&A) expenses: These are the indirect business costs, such as rent, utility costs, marketing, salaries for administrative staff, travel expenses, and other business expenses your company needs.

15 Tips To Lower Your Operational Cost

We’ve compiled a list of the top 15 tips to help you lower your operational costs. Read through this and understand how you can leverage each strategy for your business.

1. Negotiate

Now that you know where your operating expenses are coming from, you should focus on two of them:

- largest monthly expenditure

- longest-standing relationship

It can do magic for your bottom line if you manage to shave even 1% off of the largest monthly expenditure. Leveraging your longtime customer status with another provider can give you sizeable discounts.

So before you pick up the phone, you should research, look for promotional rates, and check in with several competitors for quotes.

Try to open your negotiations, saying, “We’ve enjoyed being your customer, but our monthly bill is getting too high for our wallet.

How can we cooperate to bring it down?” That way, you can set a synergetic tone, convince them to work with you, and help you lower your operating expenses.

When you have these prosperous negotiations, try to make it the best method of reviewing other expenses and constantly repeat that process to uncover opportunities for future savings.

2. Hire Freelancers To Do The Work

You probably know that your savings can go way beyond the simple fact that you don’t have to pay payroll taxes or give benefits to an independent contractor.

Most SMBs don’t have full-time work for non-core assignments.

Outsourcing these assignments (website maintenance, book keeping, etc.) allows you to pay for the project and get a specialist.

Hiring freelancers are always a better option than having an internal “jack of all trades”, not only because the work will be handled with more quality of the work but also because of the overall savings.

3. Change Spending Behavior Of Your Employees

Cash often also tends to leak from SMB’s operations cost in seemingly irrelevant ways, usually because of wasteful spending or hasty activities. The problem usually begins with behavior.

Typical things like misplaced pens, lost meeting notebooks, unnecessary postage, and excessive printing. Most business owners don’t question those as necessary office expenses.

A simple solution that often can save serious cash can be a little planning ahead.

It can be good to have insight into your employee’s spending habits, so you should take the time to monitor the company’s card spending every month.

Just use purchase card monitoring to see how much your staff is spending on things like fast food and drink, where they were spending, and ensure they are staying within the P-Card limits.

Armed with the knowledge of what employees are spending when traveling or out of the office can lead to the following positive actions:

-You could restrict particular online and offline stores’ MCC codes so the company purchase card can’t be used at those places.

-You could monitor the spending to determine if that spending correlates with increased productivity.

As you can see, having access to this kind of card data can lead to serious changes in your company, usually for the better.

You can find this data type using operational expense audit solution technology and see every purchase your employees make. The bottom line is that lots of data give you more insight into the heart of your company’s spending.

4. Reducing Infrastructure Costs

You can reduce infrastructure costs and keep your employees occupied with managing daily operations.

Sure, it’s a brilliant move, but you’re probably not convinced you can do it.

Don’t worry. You can accomplish that by following the tips that are written below.

Move your SMB to a smaller office space. You can replace old-fashioned offices with a shared workspace for clients/customers to meet, and your employees can collaborate.

This way your staff will share workspace, desks, and means at the office.

You can notably reduce rent and similar costs (insurance and utilities, for example) with a little creativity.

5. Telecommute

As I already said, infrastructure costs can drain your funding.

Depending on the industry of your SMB, you should allow your staff to telecommute. They can work from home for a particular part of their working week. Working from home is usually a favorite perk among employees, as they can reduce their commute time and expenses.

That can significantly improve employee satisfaction – creating a win-win situation for everyone.

With the connectivity available now, the difference between a staff member sitting in an office and at home is almost indistinguishable.

The number of SMBs that have teleworkers is growing because of many advantages that can arise from employers’ and employees’ engagement in telework.

Besides improving employee morale and productivity gains, telecommuting also reduces infrastructure costs.

6. Cancel Unused Services

You probably think this is a no-brainer, but unused services can easily continue to be withdrawn from your bank accounts or billed from your credit cards if you forget that they are left on auto-pay.

So, it would be best to look at all the company’s costs in the last six months. In case you find out that you haven’t used a certain service in 90 days, make sure to cancel it.

Also, maybe it’s time to reassess the services you still use and find cheaper alternatives or use the opportunity to renegotiate your existing contracts.

This approach is called “spend analysis.” Spend analysis is the process of collecting, cleansing, classifying, and analyzing spending data with the purpose of cutting down procurement costs, improving efficiency, and monitoring accordance.

It would be best if you were interested in learning about this new technology of collecting and managing spending data, along with the growing acceptance of knowing how to operate your spend and understand it.

Those are some reasons why this new method has raised interest in spend analysis from many SMBs and large companies and is performed every quarter. You can find out more about spend analysis here.

7. Use An Online Bill And Pay Software Program

Implementing an online bill and pay software program can eliminate paperwork and save about 50% of payment time and bill approval.

Paying your company’s bills (and any other bill for that meter) online is a great benefit that the Internet offers us.

So, it would be best to consider using an online bill pay service and set up a secure online account that allows you to pay all your bills from one place.

This way, you can save time, plus automated payments will help you avoid late payments. Many banks offer some bill-paying features via their website.

Use an online bill pay service, and you will probably never receive another paper bill again.

This service can make payments to any individual or company in the U.S.

If you want to be more secure and like to keep a record, you can demand images of bills and payment information that are retained for seven years on a CD with bill payment data for every year on it.

8. Inventory And The Strategy To Reduce The Cost

Many SMBs are looking for ways to reduce expenses and often ignore the effect of inventory sitting in the warehouse and the expense of keeping that inventory on their finances.

Usually, inventory expenses can run a serious percentage of a company’s fund, but that depends on the industry.

Inventory carrying expenses include taxes, capital expenses (you need it for financing the inventory purchase), insurance, warehouse, labor and administrative staff for operating the warehouse, material handling, equipment, utilities, etc.

Inventory carrying expense can add up to 25% or more of the inventory rate on top of the inventory expense.

As Omar Khan (a senior consultant with Procurement Solutions Group) says, “The larger the volume of “on-hand inventory,” the higher the carrying cost and total cash layout of the business.

Hence, the “single most effective approach” to reducing the operating costs of a small business is to reduce the on-hand inventory and associated carrying costs.”

So, to reduce your costs significantly, you should focus on the inventory features that make up a large percentage of the inventory rate or expense.

These items usually are maintenance supplies, consumables, raw materials, etc. – depending on the type of SMB we are talking about.

Therewithal of the type of SMB however, the main goal is to cut down the quantity/volume of those large ticket pieces from the warehouse.

You can push those items back to their manufacturing facility or the suppliers’ warehouse and pick up only the quantity/volume consumed, used in daily/weekly manufacturing at your business, or sold.

If SMB is resource-constrained, it makes perfect sense to keep an outside consultant or expense reduction service provider that offers contingency-based service.

Inventory expense reduction is unquestionably the best and most effective cost reduction strategy that will harvest the most benefit with the least effort compared to other expense areas.

9. Go Green

Consider making your SMB’s office space as green as possible to reduce energy usage.

You can do that by replacing regular light bulbs with compact fluorescent lighting. Also, you should find a way to reduce heating and cooling expenses by improving your windows and insulation and consider reducing the volume of physical waste.

It’s very important to encourage your employees to communicate via email, Skype, or other electronic means – ask your vendors to do the same. Going green will drastically decrease the expense of the company’s monthly office supply order.

10. Energy Efficiency Measures

Implement energy-saving practices and invest in energy-efficient equipment. This not only reduces your environmental impact but also lowers utility bills over time.

11. Cross-Train Employees

Cross-train your employees to perform multiple roles within the organization. This ensures flexibility in resource allocation and reduces the need for hiring specialists for every task.

12. Outsource Non-Core Functions

Consider outsourcing non-core functions, such as customer support or data entry, to specialized service providers. This can often be more cost-effective than handling everything in-house.

13. Implement Technology Automation

Invest in automation tools and technologies to streamline repetitive tasks. Automation can increase efficiency, reduce errors, and minimize the need for manual labor.

15. Implement A Cost-Cutting Culture

Foster a cost-conscious culture within your organization. Encourage employees to suggest and adopt cost-saving measures and reward innovative ideas contributing to operational efficiency.

15. Optimize Marketing Strategies

Analyze the performance of your marketing strategies and focus on the most effective channels. Redirect resources towards methods that generate higher returns on investment and eliminate or reduce spending on less effective ones.

Why Are Operating Costs Important?

Operating costs are important because these can affect the profitability of your business.

The lower your operational cost is, the higher your profit margin becomes. Let’s say it’s better for your cash flow!

What Does Lower Operating Costs Mean?

When we say “lower operating costs,” it generally means reducing the expenses incurred by your business. It’s like tightening your belt daily for your business and finding ways to do more with less.

There are a couple of benefits lowering your operational costs can bring your business, such as:

- Increased Profitability: Every dollar you save on operational costs can go straight to your bottom line, boosting your profit margin. This allows you to reinvest in your business, grow faster, and potentially offer more competitive pricing.

- Improved Efficiency: A lower operating cost can improve your efficiency. You’re most likely finding ways to do things smarter with less waste and duplication of efforts. This translates to a more streamlined business.

- Enhanced Sustainability: Reduced costs can also signify a more sustainable business model. When you utilize your resources efficiently, you minimize waste.

- Greater Financial Resilience: Lower operating costs can make your business more resilient to economic downturns or unexpected expenses. With smaller base of fixed costs, it becomes easier to weather rough patches with less impact on your bottom line.

Lowering Your Costs With ProcureDesk

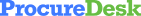

ProcureDesk has the necessary features to help you control business costs and even monitor your budgets.

ProcureDesk has built-in budget tracking & controls so you can stay under budget.

Setting up the budget or importing from a spreadsheet or a system like QuickBooks Online is easy.

After setting up the budget, employees can choose the appropriate budget for the purchase.

The system checks for the available budget and helps you keep the cost under control.

You can decide how you want the system to proceed if an adequate budget is unavailable.

For example – show a warning message when the budget is unavailable or block a purchase when a budget is not available.

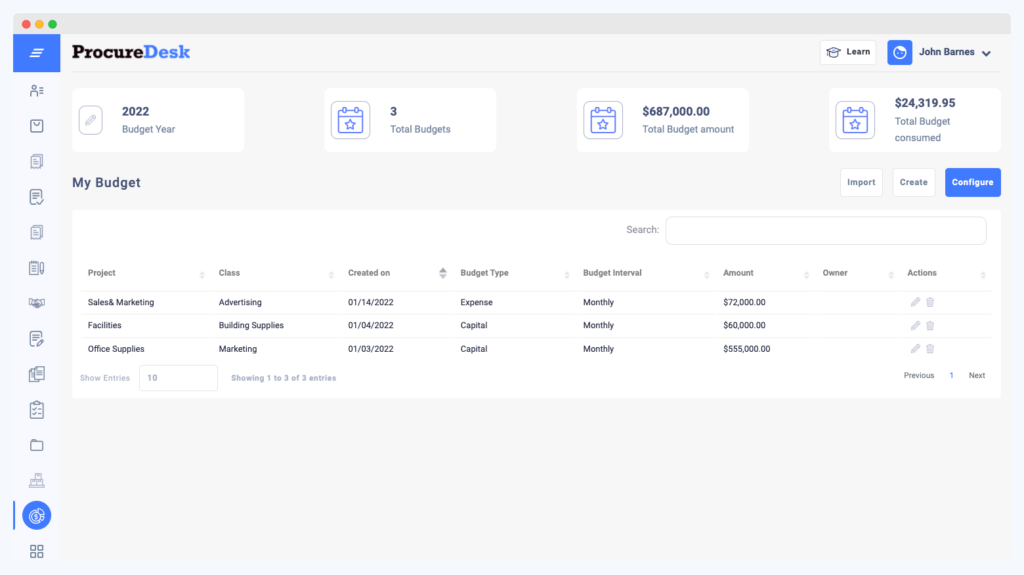

Aside from that, ProcureDesk also has a cost control dashboard to help you gain cash flow visibility.

The cost control dashboard provides you with exactly that.

With the Spend Management dashboard, you can see all your spending in one dashboard.

For example:

You can see what you are purchasing, from whom, and who is purchasing within your company.

You can track monthly spending trends to keep a pulse of purchasing behavior within your company.

Or you can track the payment terms across the vendors and identify opportunities for negotiating better payment terms.

Extending the payment terms is probably one of the most important levers in increasing the cash flow.

Of course, you need a good credit history with the vendor. That is why it is important to move to an invoicing process so that you can build up the credit history with the vendor.

As you scale your operations, you can pay the vendor sooner than the agreed terms and avail of any early payment discounts.

You can review the open order report to track your open commitments.

An open report gives you a quick snapshot of how many purchase orders are open, what is already invoiced, and what is pending invoiced.

You can use this information to plan your spending better.

FAQs

Why Is It Important For You To List Your Operational Costs?

When you carefully list your operating costs, you can see all the costs your business is carrying. A handful of operating costs would fall in the bucket of unnecessary.

Those operating expenses often can fall below the SMB’s owner threshold of concern. Bring together all those small cash leaks and put them out of your misery once and forever.

The next step is to check your list again and search for controllable operating costs.

It would be best if you started tracking those expenses.

Remember – “what gets measured gets managed!” In other words, you can reduce your operating expenses by just tracking them. However, if you actively manage the cost, the controllable costs will seriously cut down.

Every good operations consultant knows how to cut, track, and manage operating costs and to earn good fees with those three steps alone.

If you learn how to do that, you can manage your own operating costs and save even more $$$ by not hiring a consultant.

What Are The Types Of Operating Costs?

Operating costs, or OpEx, are the expenses a business incurs through its normal day-to-day operations. Think of them as the money you spend to keep your business running smoothly. There are two main operating cost categories: variable and fixed.

Variable costs change with the level of production or activity. The more you produce or sell, the higher your variable costs will be. Some common examples of variable costs include:

- Direct materials: The raw materials and components used to produce your goods or services.

- Direct labor: The wages and benefits paid to workers who produce your goods or services directly.

- Manufacturing overhead: The indirect costs associated with production, such as utilities, depreciation, and maintenance.

- Sales commissions: The commissions paid to salespeople for each unit they sell.

- Shipping and delivery costs: The costs of shipping and delivering your products to customers.

Fixed costs, on the other hand, remain the same regardless of the level of production or activity. Some common examples of fixed costs include:

- Rent: The cost of leasing the space you use to conduct your business

- Utilities: The cost of electricity, water, gas, and other utilities.

- Insurance: The cost of insurance for your business, such as property and liability insurance.

- Salaries: The salaries paid to employees not directly involved in production, such as administrative staff and managers.

- Marketing and advertising expenses: The costs of marketing and advertising your products or services.

How To Calculate Operating Costs?

Calculating your operating costs involves summing up various expenses involved in running your business. Here’s a breakdown of the process:

1. Gather your financial statements: You’ll need access to your income statement and balance sheet. These documents provide detailed information about your revenues and expenses.

2. Identify Cost Categories: Separate your expenses into two main categories:

- Variable Costs: These fluctuate based on your production or activity level. Examples include raw materials, direct labor, and shipping costs.

- Fixed Costs: These remain constant regardless of your activity level. Examples include rent, salaries, and insurance.

3. Calculate Cost of Goods Sold (COGS): This represents the direct costs of producing your goods or services. Use the following formula:

COGS = Starting Inventory + Purchases – Ending Inventory

4. Find Selling, General, and Administrative (SG&A) Expenses: These are indirect business costs, excluding COGS. Look for items like marketing, advertising, rent, and administrative salaries in your income statement.

5. Combine the Numbers:

Total Operating Costs = COGS + SG&A Expenses + Fixed Costs

This sum represents the total expenses incurred by your business in its day-to-day operations.

The Bottomline

Reducing operating expenses for your small to medium-sized business can be hard but isn’t impossible.

Learning how to lower operating costs needs discipline and employee buy-in. It can take some time for you to get used to working within a lean budget, but you will be comfortable with that when you realize how important that step is for your business.

Don’t get me wrong, you should never be afraid to spend money on employees and the services you need, but take extra time to consider the long-term expense of ongoing expensive technology or services.