Traditional AP processes are slow, error-prone, and costly for many businesses. Tracking, processing, and filing paper invoices can consume valuable time and resources, leaving AP teams struggling to keep up.

With paperless accounts payable, you can improve the efficiency of your Accounts payable team and cut your processing time by more than 50%.

With accounts payable automation, you can achieve the following results:

- 80% reduction in paper invoices.

- Automated matching of purchase orders with invoices.

- Faster processing of invoices, leading to faster invoice approvals.

- There is no need to manually enter invoices into your ERP or accounting system. Invoices are automatically synced, avoiding manual data entry.

In this guide, we will show you a step-by-step process for automating your accounts payable and implementing a paperless AP process.

The Problem With Paper: Common Accounts Payable Pain Points

Manual Data Entry Challenges

When AP staff manually enter invoice details, the risk of errors increases dramatically. Missed payments, duplicate entries, and data inaccuracies can lead to costly mistakes and strained vendor relationships. Lost invoices can cause business disruption.

Storage And Retrieval Issues

Keeping paper invoices means you’re dealing with physical storage limitations and the potential loss of important documents. Retrieving invoices for audits or record-keeping can be time-consuming and frustrating.

Environmental Impact And Hidden Costs

Paper-based processes aren’t just inconvenient—they’re expensive and unsustainable. Companies waste thousands of dollars annually on paper, printing, and storage while contributing to environmental harm.

How A Paperless Accounts Payable System Solves These Problems

Transitioning to a paperless AP system can eliminate these issues and bring your accounts payable process into the 21st century. In this section, we will cover an AP automation solution that can help automate the process of invoice capture.

We will discuss how our ProcureDesk accounts payable software can help with AP automation.

1. Digital Invoice Capture

Manual data entry is prone to human error. There are multiple ways to automate the process of capturing invoices from vendors and using OCR (Optical Character Reading) technology to create the invoice from a document automatically.

Here are a couple of ways to automate invoice capture and implement a paperless system.

Create Invoice From Email

The first step towards automating the invoicing process is to centralize the capture of the invoices if your AP department doesn’t have a central email to receive invoices, set up a designated email address, such as invoices@yourcompany.com, solely dedicated to receiving electronic invoices from vendors.

Ensure all vendor correspondence includes the new email address for invoice submissions. Inform internal teams and request that they forward any invoices they receive to this designated email.

ProcureDesk AP software can read all invoices from the email and use the OCR and AI combination to create the invoice process for you. The AP team doesn’t need to follow a manual process to download and upload each invoice in your accounting system.

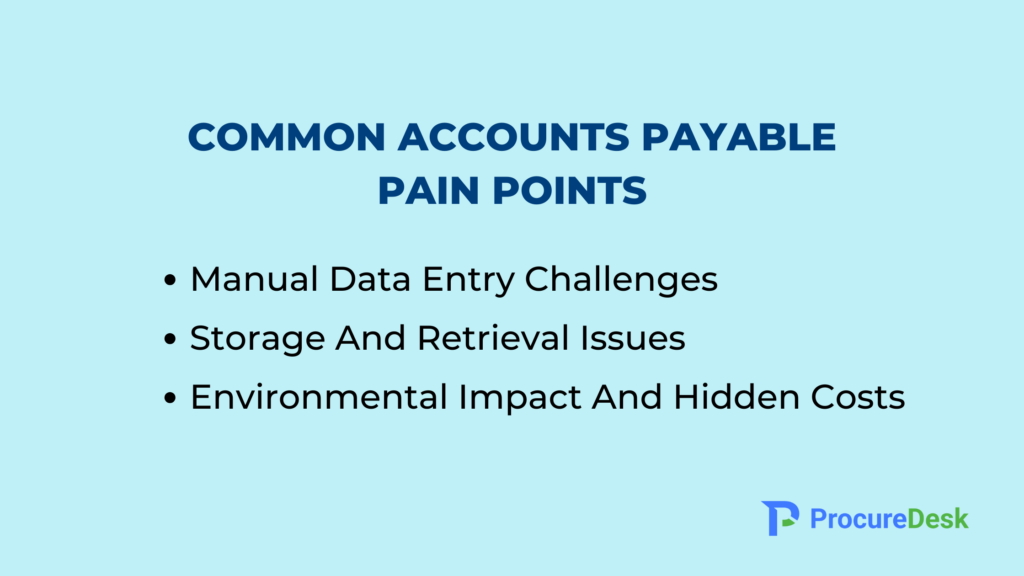

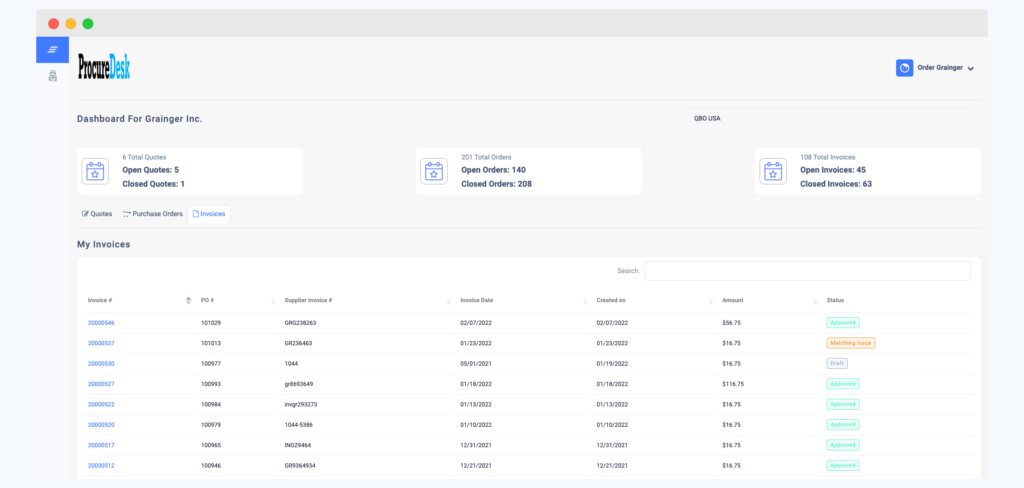

Here is an example of an invoice created by the AP software:

The system provides a central place to track all your invoices, so you don’t have to print and store them in filing cabinets.

Vendor Portal For Supplier Self-Service

You can also implement a vendor portal to have a completely automated system. This ensures that the paperless invoices are directly created in your new system.

A vendor portal allows vendors to submit their invoices through a web portal. The invoices can be submitted against an open purchase order or without a purchase order.

The system automates the end-to-end invoice processing by matching it and sending it to stakeholders for invoice approval.

Here is an example of how vendors can use the portal for self-service:

Electronic Invoices

With electronic invoices, you can reduce invoice processing costs, increase invoice accuracy, and avoid data entry errors.

With electronic invoices, the vendor directly sends the invoice to an AP automation software like ProcureDesk.

There is no need to email or manually upload the invoices using a vendor portal. The data is transferred electronically from one system to another.

Once the invoice is received, it is automatically matched with other documents like purchase orders and receipts. Since the data is automatically created, the accounts payable department only has to focus on resolving any matching discrepancies.

There are two common protocols used for electronic data transfer:

- EDI (Electronic Data Interchange): The buyer and supplier must implement this protocol to exchange data seamlessly.

- cXML (commerce eXtensible Markup Language): A widely used protocol for exchanging invoice data and supplier information.

2. Automated Approval Workflows

No more chasing down approvals! ProcureDesk’s customizable workflows route invoices to the right person, sending reminders for pending approvals and helping you pay vendors on time.

With automated workflows, you can ensure that all invoices are approved before payment to the vendor. You can set different workflows based on your needs, for example:

- Approval workflow based on the department.

- Approvals that are based on the GL code or cost center.

- Multiple levels of approvals depending on the amount of the invoice.

The system sends automated notifications for pending invoices so that invoices are approved on time.

To enable faster invoice approvals, the system provides several options to approve the invoices.

Email Approvals

Invoices can be approved directly from an email without the need to log in to the system. There is built-in collaboration, so all the back-and-forth related to invoice approvals is handled within the system.

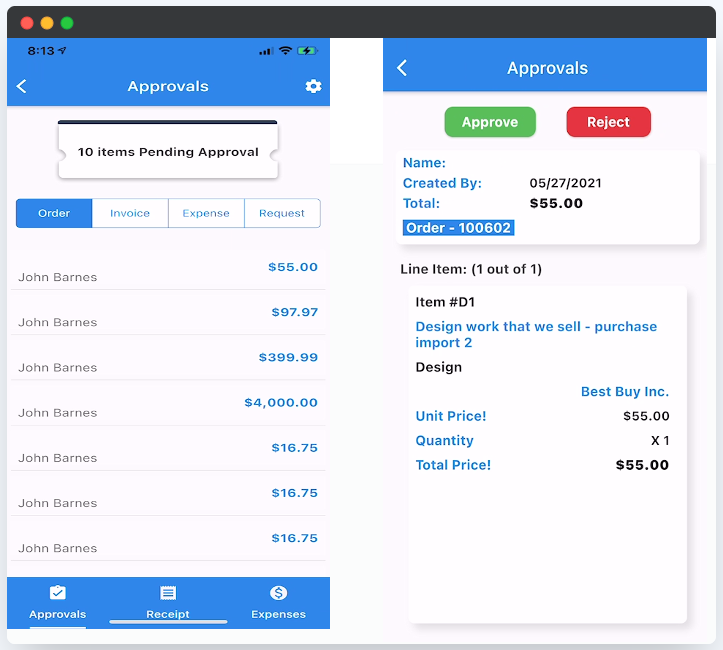

Mobile App

Mobile app allows you to approve invoices on the go. You can quickly approve invoices without the need to be in the office. Here is an example of how a mobile app implies the approval process

Web App

You can also use the web app for approvals. The system provides a central dashboard so that you can review your pending requests in one place and approve the invoices quickly.

The approval dashboard streamlines the approval workflow, providing a user-friendly experience and ensuring no requests are overlooked or delayed. This centralized approach enhances efficiency and transparency, allowing users to stay on top of their approval tasks and maintain smooth financial operations.

While real-time emails for approvals are effective, it’s common for managers to get caught up in their daily tasks and overlook approving invoices promptly.

To address this, automatic reminders, such as summary reminders, prove highly beneficial. With summary reminders, the system sends a daily summary of all pending items that require approval.

3. Invoice matching

Even though ProcureDesk automates invoice approvals, you can avoid invoice approvals completely and further streamline your payable and payment process.

With invoice matching, you can do the following:

- Match the invoice with purchase orders and receipts to ensure that you are paying what was ordered and received. This is called 3-way matching

- Match the invoice with the purchase order and send the invoice for stakeholder review. This is called 2-way matching and is commonly used for service-based purchase orders.

It not only reduces the time for processing invoices for payments, you can also see the following benefits:

- Avoid duplicate payments to vendors because the system automatically identifies if the invoice amount exceeds the purchase order amount.

- You can easily route the invoices to other stakeholders like procurement to resolve any pricing discrepancies.

An accounts payable software should offer automatic two-way and three-way matching and identify any discrepancies.

For instance, in the case of a missing receipt exception, the system automatically generates an email to the respective stakeholder who ordered the product, seeking confirmation of receipt. This automated follow-up minimizes manual intervention and enhances efficiency.

Similarly, when encountering a pricing exception where the invoice price differs from the purchase order amount, the software provides two resolution options:

- Setting a tolerance level: The system can be configured to accept small deviations within a specified tolerance level, reducing the number of exceptions raised.

- Routing for review: The software can route the invoice to a designated buyer to review and confirm the price change, ensuring proper validation.

An effective invoice approval workflow ensures that any price exception requests are efficiently directed to the relevant person for timely resolution.

4. Real-Time Data Access For Audit

Cloud storage gives AP teams instant access to invoice data from anywhere. No more digging through filing cabinets or waiting to get back to the office to check a vendor payment.

With everything online, you can pull up an invoice in seconds, whether you’re at your desk, in a meeting, or working remotely.

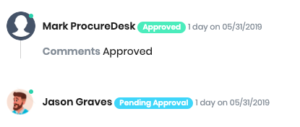

ProcureDesk simplifies audits by creating a complete digital trail of every invoice and approval.

Auditors can quickly access the entire transaction history, seeing exactly who approved each invoice, when it was approved, and the precise workflow it followed. No more hunting through physical files or reconstructing payment processes. Every detail is timestamped and documented, from initial receipt to final payment.

This digital audit trail eliminates manual reconciliation, reduces errors, and provides immediate transparency. Compliance becomes straightforward when all approval information is centralized, searchable, and immediately retrievable with just a few clicks.

Here is an example of an audit trail in the system:

5. Vendor Payments

Handling vendor payments with paper checks can be a hassle. The process is time-consuming, costly, and error-prone, from printing and mailing to reconciling payments. With ProcureDesk, you can simplify this process by switching to electronic payments.

ProcureDesk offers an easy way to automate payments through methods like ACH transfers and virtual credit cards. This eliminates the need for printing and mailing checks, saving time and cutting costs on materials and postage. Plus, electronic payments ensure faster transactions, keeping your vendors happy and your payment process stress-free.

With ProcureDesk, you gain more control and visibility over your payments. Built-in workflows help you manage approvals and ensure compliance with your internal policies, reducing the risk of errors or fraud. Real-time tracking of payment statuses means you always know where your money is going and when it arrives.

Switching to electronic payments is efficient and environmentally friendly. By eliminating paper checks, you reduce waste and contribute to sustainability efforts.

6. Seamless Integration With Your Accounting Software

ProcureDesk easily integrates with popular accounting platforms, keeping all your financial data synchronized and ensuring a smooth workflow without manual data transfers.

Once the invoice is approved, the system automatically sends the approved invoice to the accounting system. There is no need for manual data entry into your accounting system.

ProcureDesk supports native integration with the following accounting and payment systems:

- QuickBooks Online

- QuickBooks Desktop and Enterprise

- Xero

- Sage Intacct

- Microsoft Business Central

- Oracle NetSuite

- Bill.com – for payments.

With native integration, the system pulls all the relevant information like the chart of accounts, supplier list, project codes, and so on. The invoice is automatically pushed to the accounting system without any manual intervention.

The system also pulls the payment information back from the accounting system an updates the payment status of the invoice.

Real Results: ProcureDesk In Action

Don’t just take our word for it—see how ProcureDesk has transformed AP for other businesses:

“ProcureDesk saves us 25% to 35% percent of the time that we used to spend on processing invoices, which is huge” – Kevin Slatnick, CFO – Coast Flight

You can read more about Coast Flight and how they reduced the time spent processing invoices by more than 30%.

ProcureDesk is trusted by businesses across industries to streamline their AP processes and reduce costs. Our clients consistently see improved accuracy, faster processing times, and happier teams.

Getting Started With Paperless Accounts Payable: Step-by-Step Guide

Thinking about going paperless? Here’s a quick guide to help you make the transition:

1. Assess Current AP Processes

Start by identifying inefficiencies in your current AP workflow. Where do errors typically occur? Which steps consume the most time? Understanding these areas will help tailor the solution to fit your needs.

Determine the volume of the paper documents being handled and the associated costs. Assess the readiness of your team so you can embrace digital changes and ensure that your key stakeholders are on board with the transition.

When you understand your starting point, you can develop a clear vision for the paperless transformation and commit to making it a reality for your business.

2. Choose The Right Digital Solution

Your paperless AP system should match your business’s unique needs. ProcureDesk offers flexible, customizable features to suit companies of all sizes and industries.

Considering numerous paperless accounts payable software options, you must carefully evaluate your business requirements.

Choose a solution that meets your needs. Look for features such as automated invoice processing, digital document storage, a user-friendly interface, optical character recognition (OCR), and integration capabilities with your existing accounting systems.

3. Implement And Train

Ensure a smooth transition by providing training sessions for your AP team. ProcureDesk offers user-friendly tutorials and customer support to make onboarding seamless.

Streamline your document management by digitizing paper documents and converting incoming invoices through advanced scanning or OCR technology.

Implementing automation software eliminates the cumbersome manual data entry process and optimizes your payable workflow.

To ensure seamless integration, ensure your paperless accounts payable solution will be seamlessly integrated with your existing accounting software and facilitate smooth data transfer and reconciliation.

Enhance the efficiency of your invoice approval process with an electronic system. Our automated routing and tracking of invoices will minimize the risk of errors and delays, ensuring a smooth and efficient approval workflow.

4. Monitor And Optimize

As you implement the paperless accounts payable workflow, continuously monitor your progress toward achieving your goals.

Measure the success of your transition using key performance indicators (KPIs) such as processing time, error rates, and cost savings.

Regularly review your data and adjust as needed to optimize the workflow further.

Frequently Asked Questions

How Secure Is A Paperless Accounts Payable System?

ProcureDesk uses advanced encryption and security protocols to ensure your data remains safe and confidential.

Can ProcureDesk Integrate With My Existing Accounting Software?

Yes, ProcureDesk integrates seamlessly with popular accounting systems, including QuickBooks, Xero, and others.

What Is The Typical Implementation Timeline?

Most businesses can transition to a paperless AP system within 2-3 weeks with ProcureDesk.

What Are The Benefits Of Going Paperless In Your Accounts Payable?

Going paperless in accounts payable streamlines processes reduces errors, and saves time by eliminating manual data entry. It enhances cash flow visibility, improves approval workflows, and ensures timely payments.

Paperless systems also lower costs associated with printing and storage while fostering sustainability by reducing paper waste, making them efficient and environmentally friendly.

How Do You Digitize Accounts Payable?

Digitize accounts payable with ProcureDesk by automating invoice approvals, matching POs to invoices, and eliminating manual entry. Upload invoices, track approvals in real time, and sync data with your accounting software. ProcureDesk simplifies workflows, enhances visibility, and reduces errors, making AP processing faster and more efficient.

How Do I Organize My Accounts Payable Files In ProcureDesk?

Organize accounts payable in ProcureDesk using filters to sort by vendor, date, status, or amount. Save custom views for quick access and combine filters for precise searches. This streamlines document management enhances efficiency and ensures you quickly find what you need to keep your processes running smoothly.