Audit-proof your company before it’s too late. Read this.

For Finance leaders at scaling companies, growth is a double-edged sword. While revenue climbs, so does operational complexity. The informal spending habits that allowed your organization to move fast in the startup phase—sharing credit cards, slack-based approvals, and reactive invoice processing—inevitably hit a wall.

That wall usually manifests as your first serious audit, or perhaps the implementation of SOX-lite requirements as you approach the 100-500 employee mark.

Table of Contents

TL;DR:

- The Risk: As companies scale beyond 100 employees, decentralized spending creates a “compliance gap,” leading to unapproved liabilities and audit failures.

- The Reality Check: Corporate cards are payment tools, whereas a procurement system provides pre-spend control to prevent fraud.

- The Fix: Audit-proofing your process requires defining expense policies, establishing approval limits, enforcing preferred vendors, and implementing 3-way matching.

- The Solution: Automating these controls is the only scalable way to ensure compliance without slowing down operations.

At this stage, “agility” often looks dangerously like “negligence” to an auditor. The lack of visibility into committed spend creates unapproved liabilities that distort cash flow forecasting and expose the organization to fraud. To bridge the gap between startup chaos and enterprise maturity, Finance teams must shift their focus from merely facilitating payments to controlling obligations.

The Compliance Gap: Why Basic Tools Fail at 100+ Employees

There is a distinct “Scaling Gap” that occurs when an organization expands beyond a single location or exceeds 100 employees.

The “Scaling Gap” Risk

In the early days, centralized control was easy because the CEO or Founder approved every significant expense personally. However, as you scale, delegation becomes necessary. Operational managers need to buy software, inventory, and logistics services to keep the business moving.

Without a dedicated infrastructure to manage this, companies often rely on corporate credit cards and decentralized AP processes.

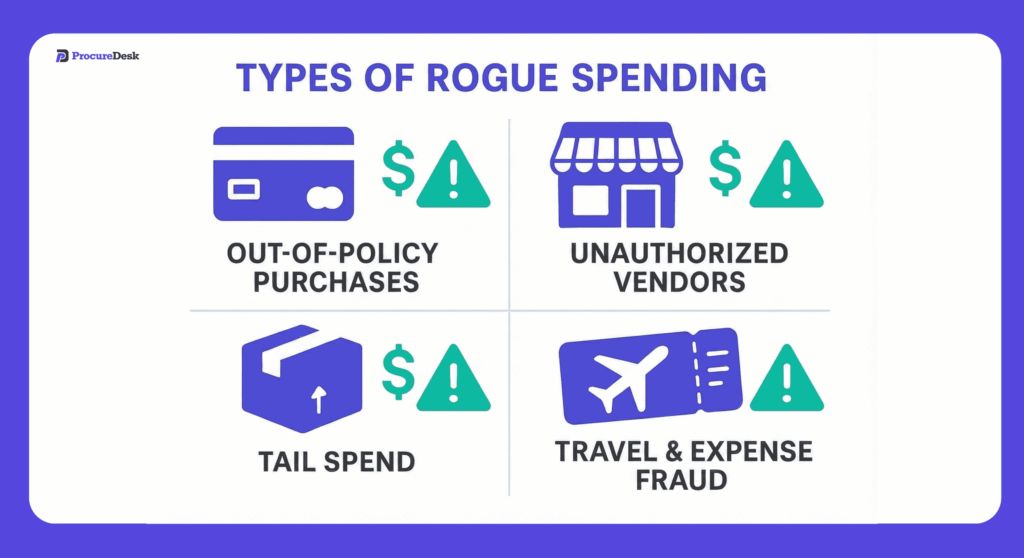

The Hidden Cost of “Maverick Spend”

The result of this decentralization is “maverick spend”—purchases made outside of agreed-upon contracts or without prior financial approval. For a Controller or CFO, this creates a nightmare scenario: you are often the last to know about an expense. By the time the invoice arrives or the credit card statement is reconciled, the money is already gone.

This lack of pre-spend authorization is the primary driver of audit failures in the mid-market. It is not just about messy data; it is about a fundamental lack of internal controls.

Audit Your Process: 3 Signs Your Spend is “Invisible”

- Reactive Accruals: Do you frequently discover material expenses only after the invoice lands in the AP inbox?

- Vendor Sprawl: Do you have multiple vendors providing the same service across different departments without negotiated rates?

- The “Verbal” Approval: Are substantial purchases being made based on Slack messages or hallway conversations rather than documented authorization?

What is a Procurement System and How Does It Ensure Control?

Many finance professionals mistakenly equate “procurement” with “purchasing.” However, in the context of compliance, the distinction is critical.

A procurement system is a structured framework of internal controls and policies (not just software) designed to govern organizational spending. Unlike simple payment tools, it manages the entire lifecycle—from Requisition, Approval, Purchase Order, and Payment—ensuring every dollar is accounted for before cash leaves the bank.

System vs. Software: Understanding the Distinction

While software is the enabler, the system itself is the governance model. It ensures that no liability is created without a digital paper trail.

The Lifecycle of Financial Control

A robust procurement system handles the entire lifecycle of spend:

- Requisition: A formal request is made by an employee.

- Approval: The request is routed based on budget, department, and dollar value.

- Purchase Order (PO): Once approved, a PO is issued to the vendor (the legal contract).

- Goods Receipt: Confirmation that services/goods were delivered.

- Payment: The invoice is matched against the PO and Receipt.

By enforcing this workflow, you eliminate the “compliance gap.” You are no longer chasing receipts; you are pre-approving investments.

Read More: Purchase Order Software: The Technical Foundation of Control

4 Steps to Building an Audit-Proof Framework

Building a compliance-ready procurement system requires a shift in operations. It is not about adding red tape; it is about establishing financial safety. Here is the handbook for establishing a framework that satisfies auditors and protects the bottom line.

1. Define a Clear Expense Policy

Ambiguity is the enemy of compliance. Your policy must eliminate gray areas. It is not enough to say “spend responsibly.” You must define specific thresholds for capitalization vs. expense, travel limits, and software subscription protocols. If the rules are not explicit, you cannot hold employees accountable for breaking them.

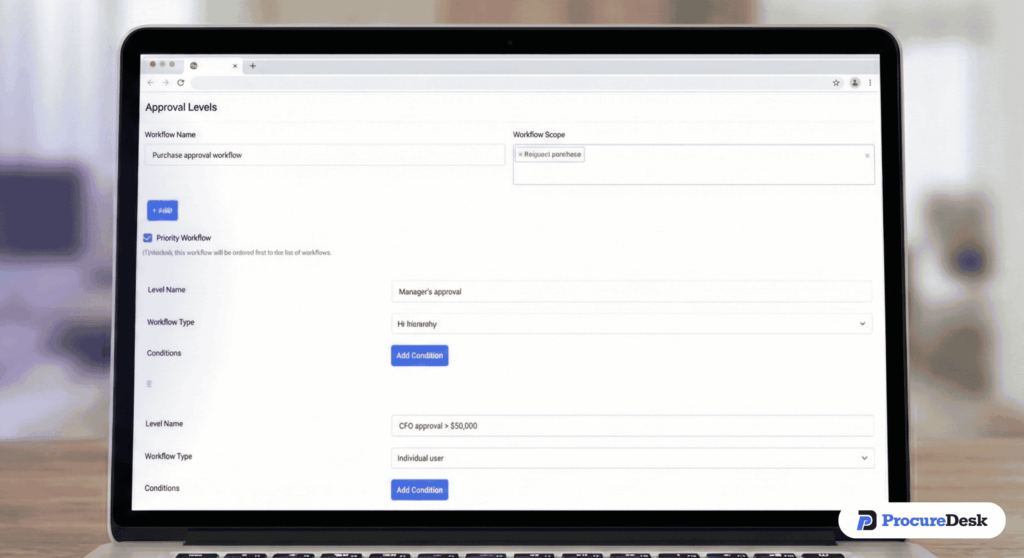

2. Establish Approval Limits

Fraud often occurs when approval hierarchies are flat or non-existent. You must establish strict approval limits based on role and department. For example, a marketing manager may have a $5,000 limit, while the VP of Marketing has $20,000. Anything above that triggers CFO review. This segregation of duties is a requirement for most internal control frameworks.

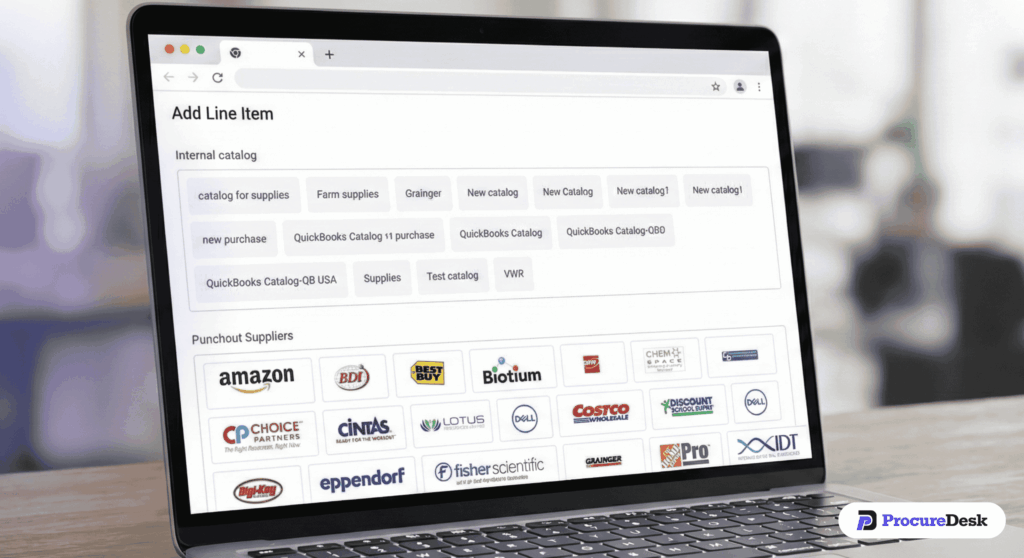

3. Enforce Preferred Vendors

Leakage occurs when employees bypass negotiated contracts to buy from non-approved suppliers. A procurement system should centralize your vendor master list. By forcing employees to select from preferred vendors, you ensure volume discounts are realized and tax/insurance documentation is already on file.

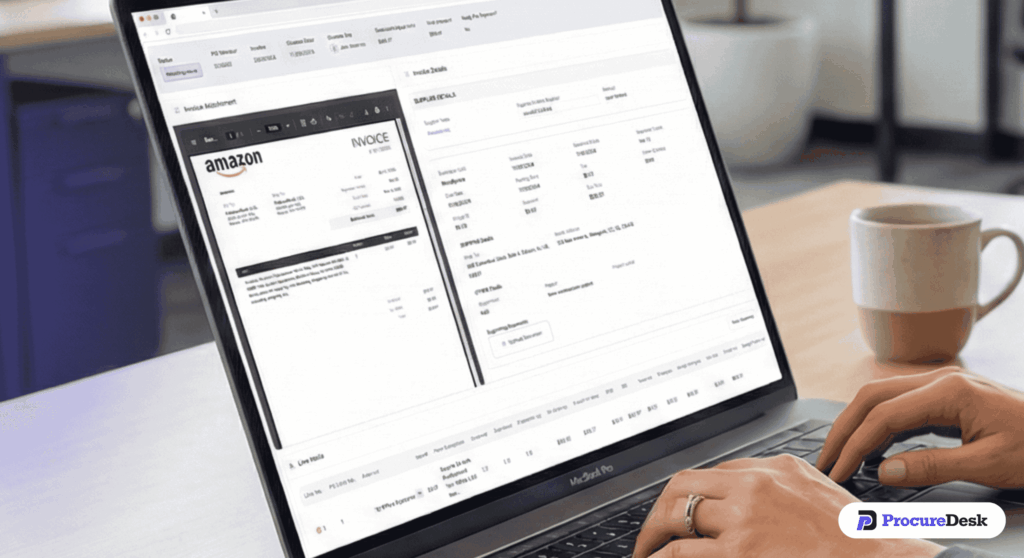

4. Implement 3-Way Matching

This is the gold standard for mid-market compliance. 3-Way Matching automatically compares the Purchase Order(what you ordered), the Receiving Report (what you got), and the Invoice (what you are billed). If these three do not match, the invoice is flagged. This check prevents overbilling and ensures you only pay for what was actually received.

Audit Your Process: The Workflow Check

- Does your current workflow flag invoice discrepancies automatically?

- Can you trace a payment back to its original approval with one click?

- Are your approval matrices hard-coded, or relied upon by memory?

Read More:

Structured Approval Process: Designing Workflows that Work

Procurement Cost Savings: How Compliance Drives Profit

Automating Controls: How ProcureDesk Enforces Policy

The challenge with the framework above is manual enforcement.

You can implement the 4 steps above using spreadsheets and email, but it creates a massive administrative burden. Expecting a Controller to manually cross-reference every invoice against a PDF of approval limits is prone to human error.

This is where procurement management software like ProcureDesk becomes essential—not to replace the process, but to enforce it automatically.

Moving From Detective to Preventative Controls

ProcureDesk automates the “policing” of spend. Instead of Finance playing the “bad cop” via email, the software proactively blocks requests that do not meet your established rules.

- If a user tries to exceed their budget, the system flags it immediately.

- If a user tries to buy from an unvetted vendor, the request is routed to legal or finance for vendor onboarding first.

This moves your team from “detective controls” (finding errors after they happen) to “preventative controls” (stopping errors before they happen).

Read More: Spend Management Software: A Category Overview

Comparison: ProcureDesk vs. Corporate Cards (The “Free” Trap)

A common objection we hear from Finance leaders is, “We use Ramp/Bill.com/Brex, so we have spend control.”

These tools are excellent payment mechanisms, but they are not procurement systems. They facilitate spending; they do not control the operational lifecycle of a purchase, particularly for COGS, inventory, or complex services.

Pre-Spend Control vs. Post-Spend Visibility

Corporate cards offer post-spend visibility. A procurement system offers pre-spend control.

Here is the difference:

| Feature | Corporate Cards (Ramp/Bill.com) | ProcureDesk (Procurement System) |

| Primary Focus | Post-spend visibility. Great for T&E and small, low-risk transactions. | Pre-spend control. Essential for operational spend, COGS, and Inventory. |

| Timing of Control | Reactive. You see the charge after the card has been swiped. | Proactive. You approve the commitment before the vendor is hired. |

| Budget Impact | Alerts you when you have already gone over budget. | Prevents the PO from being issued if budget is not available. |

| Audit Trail | Shows who paid and when. | Shows who requested, who approved, who received, and who paid. |

| 3-Way Match | Non-existent. | Automated and native to the workflow. |

If your goal is to prevent fraud and pass audits, a credit card statement is insufficient documentation. You need a system that captures the intent to purchase, not just the transaction.

Read More: Procure-to-Pay System: Integrating the Full Lifecycle

Summary & Next Steps: Audit-Proof Your Process Today

Implementing a procurement system is a pivotal moment for a growing enterprise. It signals that your organization has graduated from the “growth at all costs” mindset to a disciplined, sustainable financial operation.

The peace of mind that comes with knowing every dollar leaving the company was pre-approved, tracked, and verified is invaluable—especially when the auditors arrive.

Audit Your Process Today: Don’t let your next audit be a surprise. Download our “Compliance-Ready Procurement Checklist” to evaluate your current gaps.

Don’t wait for an audit to fix your spending process. See ProcureDesk in action.